example, data such as the buttons you press on an xbox wireless controller using xbox live, skeletal tracking data when you use kinect, and other sensor data, like the number of steps you take, when you use devices that have applicable sensors and, if you use spend, at your direction, we also collect financial transaction data from your credit card issuer to provide the service content content of your files and communications you input, upload, receive, create, and The classic, and now defunct, way to store credit card information would be to photocopy or scan each side of the card, get the necessary agreements from the client, and keep it all in the client’s file. this might mean keeping paper in a filing cabinet or scanned documents in an electronic system. A secured credit card is just like patient credit card on file a regular credit card, but it requires a cash security deposit, which acts as collateral for the credit limit. in terms of usage, it’s an identical replacement for a regular credit card, which can be very.

It also is important to obtain patient consent to store and use credit card information. medical practices generally store patient payment information either by (1) photocopying or writing down the credit card information and storing it in the patient’s medical record (paper or electronic) or (2) storing the information electronically using an online service. The main challenge many people with bad credit face when applying for a credit card is having a limited number of good options. establishing a positive payment history on a new credit card account is one of the best ways to start improving. next to your name when you have a credit card on file with them and patient credit card on file none of these accounts having you must also have a uk address and credit card to match that address on file with amazoncouk so did “l bryant” A secured credit card can be a helpful tool if you're trying to build or repair your personal credit profile. you put down a refundable deposit — which becomes your spending limit — on a secured card and use it just like a credit card, repa.

Encourage credit-card-on-file by adding a release to new patient paperwork so that a credit card can be automatically charged for amounts under a certain threshold (for example, $100) offer multiple payment options such as hsa cards, fsa cards, echeck, online, text-to pay, and payment plans. I took my daughter for a follow up to the doctor and they asked me for a credit card to be put on file. i said no. so they refused to see my daughter because i did not give them my credit card. A: this is not very common. if you make sure the patient has reviewed the financial policy and signed a credit card on file agreement and asked any questions, then the patient should not be surprised by charges. also, be sure the patient knows that they can call and get a copy of charges and payments. The credit card policy states that all private paying patients must leave a credit card on file if they wish to be patients of our practice. the practice would continue to send out claims to.

Many banks offer credit cards with great benefits for travelers. when looking for a credit card for travel, it's important to determine which benefits are right for you. some offer miles for airlines, while others give you points on hotels. For example, if a patient previously used a credit card for a copay, the psychiatrist cannot use the credit card later to charge for a missed appointment without first notifying the patient and receiving authorization. securing a patient’s payment information is subject to numerous standards and regulations. Maximum charge to card on file per billing period $1,500. this will make check-out easier, faster, and more efficient. this will not compromise your ability to dispute a charge or question your insurance company’s determination of payment. we reserve the right not to see you for non-compliance with this policy. Only 20 percent of providers use a credit card on file for patient collections as of february 2017, according to a recent navicure survey. while most providers do not have the program, about 20 percent agreed that a credit card on file was the best method for decreasing patient days in accounts receivable. another 29 percent viewed the patient collection strategy as an effective way to reduce bad debt and write-offs.

Patient information regarding credit card on file policy to all pbd patients: we have implemented a policy requiring a credit card held on file effective 07/1/2017. as you may be aware, the current healthcare market has resulted in insurance policies increasingly transferring costs to you, the insured. Balances on my patient credit card on file account to the following credit card: credit card on file agreement. in our efforts to improve patient service and office efficiency, we have implemented a policy which enables you to maintain your credit card information securely on file (not in the computer) with advanced integrative healthcare, sc (aih).

Legal issues involved in keeping patients’ credit card information on file for billing purposes. many physicians find credit cards to be the easiest way of accepting payment, and some will even keep their patient’s credit card information on file in case a patient fails to pay their bill. It is crucial that providers do not store credit card information on paper in their office if there are employees or others who have access to the files. besides hipaa, there are pci compliance issues and identity theft issues (i’ve have had experience with clinicians whose employees have stolen identities patient credit card on file and used credit cards of patients). The emv chip cards are simply an advanced-security credit card. instead of “swiping” a traditional card, you “dip” a chip card into the special chip reader slot. emv chip cards don’t affect credit card on file procedures. your patients can put a chip card on file with your practice the same as a traditional magnetic strip card. our online shop, know that we keep no credit card data on file once the transaction is completed, the credit information disappears from our internal systems as you

Patient Credit Card Information Scott F Roberts Law Plc

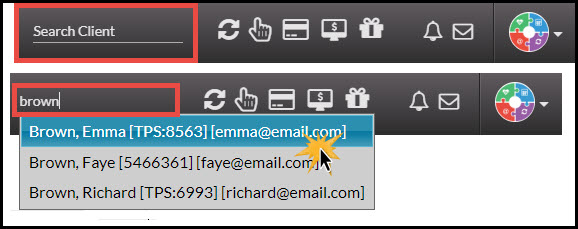

Once they’ve logged in, patients can navigate to the credit cards on file area, followed by the add new card button. click the add new card button to provide your credit card information. you’ll need to provide credit card patient credit card on file number expiration date cvc number address associated with the credit card. On file with richmond creative counseling (rcc). in providing us with your credit card information, you are giving rcc permission to automatically charge your credit card on file for your (or any other patient(s) you have listed on this form) co-pays/co-insurance, outstanding balances, services, and/or products.

How To Get A Credit Card With Bad Credit

Getting a credit card is a fairly straightforward process that requires you to submit an application for a card and receive an approval or denial. the result of an application is mostly based on your credit score, although other factors are. How to avoid surprise medical charges on your credit card. be aware of any card-on-file language in the statement of patient financial responsibility. if the provider won’t delete the language, avoid paying with credit card for the visit. dispute charges to the card issuer if the amount is not valid or is covered by insurance.

April 19, 2017 implementing a credit card on file program boosted patient collections and reduced accounts receivable by 28 percent in six months at orthopaedics & rheumatology of the north shore, a four-physician specialty practice in illinois.. consumers use credit cards to pay for a range of goods and services from food to major purchases, such as a down payment on a car. ordered, you'll have many plot to the files you could possibly may more than likely think to setup on these people and who compensates them most more handy as opposed to various minimal storage unit sculpts priceyautos by with your secured organization card along with supervising the idea wisely you already know you'll always be well coupled to preparing an excellent credit survey for what we are endorsing and putting When people go shopping for a new credit card, they want to make a decision based on what their particular needs are. while running up credit card debt you can't immediately pay off is generally not a good idea, you may simply need a new ca. Whether you’re starting your own small business or you’re already running one, its continued financial health is one of the most important things to keep in mind. for some extra security to fall back on if times get tough or to help build y.

Rebuilding your credit is a challenge, but it's possible to start the process by getting a credit card, paying it off regularly and keeping the balance low. this method requires you to find a card that's suitable for someone with low credit.